How the pandemic could reshape consumer and business behavior

What will the economic and social landscape look like in a post-pandemic world? Will the behavior of individuals as consumers and that of companies change once we leap past the consequences of Covid-19 and begin the process of restoration?

Here are five ways how consumers and businesses might change.

1. Greater diversity in supply chains/more local production

2. More flexible commuting options

3. Less business travel

4. Online delivery prevails over brick-and-mortar retail

5. Higher savings rates

Supply Chains: Global versus Local. Concentrated versus Diversified

Just-in-time delivery, which reduces warehousing costs, and the globalization of supply lines helped to drive global growth during the 1990s and 2000s. After the global financial crisis, international trade recovered to previous levels but never expanded much further. The Covid-19 pandemic has highlighted the risks inherent in relying on distant sources of production and not having a sufficiently diversified network of suppliers.

The need for closer-to-home or more diverse sources of supply is apparent both to firms which rely on components being delivered on time, and to national governments which are coming to recognize the dangers of relying on foreign producers for basic goods from medicine to microchips. Companies may also consider stockpiling a greater quantity of inventories of critical components.

The pandemic is unlikely to reverse globalization, and trade between nations will continue. However, even before the epidemic broke out, protectionism was already on the rise. In many ways, the current crisis accentuates the argument for national governments to insist on domestic production, or at least in nearby countries, of critical goods, and adds a new impetus for the private sector to diversify supply lines as well.

Finally, one emerging technology that may get a big boost is the ultimate localization-of-production/just-in-time technique: 3D printing. Already it is being used to fabricate valves for ventilators and to make face masks. Watch for more companies to explore its potential in the aftermath of the coronavirus.

More flexible commuting options

The past few weeks have given the world a crash course in virtual internet meetings and working from home. Once the pandemic abates, for many people returning to the office and reconnecting with colleagues and clients in person will come as an enormous relief. That said, in many service fields, both employees and employers have been awakened to the possibility of working from home, or from some place other than the office.

Once offices reopen for business, the world may reach a new equilibrium with more people working from home than before on any given day and fewer people driving or taking public transportation to offices. This has implications for both energy demand and office space. Moreover, if the economy doesn’t make a speedy V-shape recovery, businesses will be under pressure to reduce costs and one area in which they can reduce costs without losing talent is to rent less office space. For companies, less money spent on offices is more money that they can dedicate to other uses. For employees with long commutes, less time spent going to and from the office could result in greater productivity and more time with family and friends. Offices and commutes surely won’t disappear, but the crisis may have put the world on a path towards a new and different pattern of work-life balance.

Business travel

How much business travel is truly necessary? How much of what is accomplished during business travel can be accomplished with communications technologies like virtual internet meetings? Certainly there are strong arguments for face-to-face meetings and engaging with people as a group. In-person meetings facilitate communication in a way that even the best communication technologies can’t really match. When it is deemed safe to travel again, business travel will rebound. But how long will it take to rebound to 2019 levels? That may not come quickly. Just as office rents, business travel is another large expense for many firms. In addition to being costly for employers, business travel is also extremely time consuming for employees. If the global economy is slow to recover, it may make for an anemic rebound for airlines and hotels which cater to business travelers. It also has implications for energy consumption.

Online versus Retail

Prior to the outbreak, most consumers had a choice of shopping for items in brick-and-mortar stores or opting for online delivery. Now, with numerous store closings in many parts of the world, ordering online could be the only option for many goods.

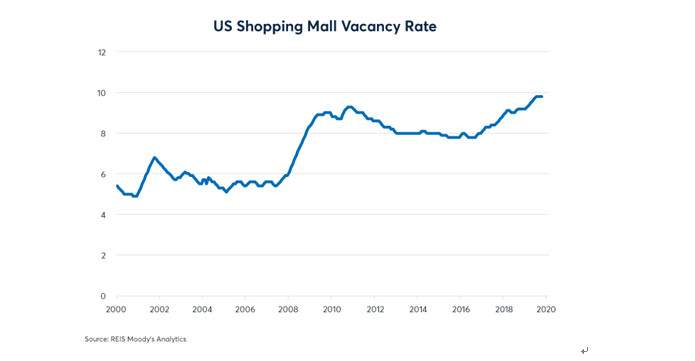

Even before the pandemic, traditional retail was under tremendous pressure. For example, in the decade before the global financial crisis, around 5.5% of stores in US shopping malls were typically vacant. That rose to 9.5% in 2009 before settling at around 8% between 2014 and 2018. In 2019, shopping mall vacancy rates rose to 10%, surpassing their financial crisis highs even with the economy at the peak of its expansion. And that was before most people had even heard the word coronavirus. Brick-and-mortar retailers won’t disappear, but just as occupancy rates never fully rebounded from the global financial crisis, landlords may have even more difficulty finding tenants for store fronts and shopping malls this time around. Moreover, the nature of retail might also be changing from buying items in-store to using the store as a showroom for consumers to experience products that they later purchase online. Changing stores from profit centers to showroom-like cost centers may have big implications for store-owners’ willingness and ability to pay rent.

Increased cash holdings

Shutting down large segments of the global economy has tested social safety nets as never before. Many nations have broadened unemployment benefits to workers not traditionally covered, offered grants so that employers can continue to compensate furloughed workers and provided assistance with rents etc. Even so, many individuals may conclude that holding more cash is the best protection against future unexpected disruptions. That was the conclusion that they reached in the aftermath of the global financial crisis. In the years before that crisis, US savings rates were historically low. Starting in 2009, Americans began to save again despite near-zero interest rates on bank deposits. In the aftermath of the current crisis, savings rates might take yet another step higher.

As public debt soars, the private sector might de-lever. Moreover, this trend might not be limited to households. Rather than borrowing money to buy back shares or paying out profits as dividends, a greater share of corporate earnings might be retained. Over the next 12 months, the US budget deficit might expand to 20-25% of GDP and public debt might grow from 104% of GDP at the end of 2019 to around 130% by this time next year. Some of this increase in public debt levels could be offset by an eventual fall in household and corporate debt ratios. This is what we observed in the US in the aftermath of the global financial crisis and is consistent with what we have seen in other nations with high levels of public debt such as Italy and Japan.

Once the current global crisis eases, many things will go back to normal. Import/export activity will resume. Stores will reopen. People will return to offices and business travel will recommence. However, what behavior becomes typical in 2021 or 2022 may look distinctly different than what seemed business as usual back at the beginning of 2020.

-- Contact us at [email protected]

-

Equip young people for the future Dr. Winnie Tang

In late February, the inaugural flight of an air taxi from Shenzhen Shekou Cruise Homeport to Zhuhai Jiuzhou Port took only 20 minutes with an estimated one-way ticket price of 200 to 300 yuan per

-

Are we raising a generation of leaders, or of followers? Brian YS Wong

The essence of education is defined not by the facts it imparts, but the potential knowledge it inspires students to individually pursue on their own. Put it this way – the ideal form of education

-

The urgent need for reforms to sex education in Hong Kong Sharon Chau

Nearly one in every four university students (23%) in Hong Kong has been sexually harassed, according to a 2019 report published by the Equal Opportunities Commission (EOC). A 2019 study found that

-

STEAM should be linked to real life Dr. Winnie Tang

In the 2017 Policy Address, STEM (science, technology, engineering and mathematics) education was proposed as one of the eight major directions to promote I&T development. Since then, funding has

-

Let trees speak for themselves Dr. Winnie Tang

I often say that smart cities start with smart planning, but smart planning presupposes adequate, systematic and up-to-date data. This is important not only for city administration, but also for tree