A multi asset perspective on Asian real estate

Asian real estate remains an attractive asset class although COVID-19 has changed the face of the sector.

Pre-COVID-19, Asia’s real estate sector was largely focused on retail, residential, hospitality and office. Going into 2021 and beyond, data centres, technology parks and logistics are likely to dominate the more traditional areas. Here we highlight two upcoming growth segments within Asian real estate equities that we favour:

Industrials

The increasing penetration of e-commerce in Asia Pacific will continue to drive warehousing demand. While some retailers have already developed sophisticated logistics platforms, late movers are likely to expand their e-commerce capabilities as buyer behaviours change permanently. This implies that industrial space in strategic, centrally located markets as well as last mile assets will remain in high demand.

Apart from the impetus from e-commerce, the industrial sector is also poised to benefit from the recovery in trade as the global economy normalises. Within Asia Pacific, the recent signing of the Regional Comprehensive Economic Partnership is likely to boost regional trade activity.

Data centres

Across different countries in Asia, mobile data grew between 25% and 71% in the first half of 2020 compared to the same period the year before. The launch of new technologies such as 5G and the Internet of Things will keep data growth high.

As consumers’ data consumption surges in low latency, high performance activities such as online gaming and AR/VR, more data storage will be needed. Enterprises are also gathering more information on consumer behaviour, driving the demand for storage and data centres.

Beyond storage, the rising usage of AI and machine learning powered applications is also boosting demand for data centres. These applications often require extensive computing resources and power, which are typically beyond the capabilities of most companies.

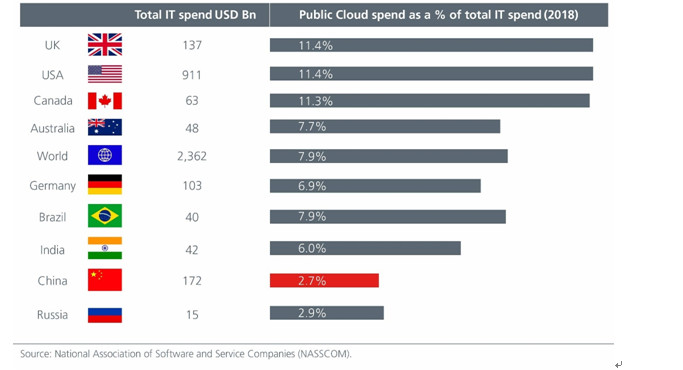

The outlook for data centres in China is particularly encouraging. While the prices of Chinese data centre stocks that we track have on average doubled in 2020, we believe that greater digital adoption in China and supportive government policies will continue to help underpin valuations. China’s cloud infrastructure services market is the second largest in the world, yet it is only one-tenth the size of the US’.

These numbers reflect the tremendous upside in China’s cloud market, and in turn for Chinese data centres. The potential is further augmented by the Chinese government’s increasing efforts to digitise the economy and the rollout of the country’s 5G network.

A positive development for China’s property bonds

The fundamental outlook for the Chinese property sector appears generally stable on the back of an expected recovery in earnings and better liquidity. The major developers' contracted sales surged by 66% in Jan 2021. While the Chinese government had historically focused on moderating bubbles in the property sector through mortgage restrictions, price caps, housing purchase restrictions and varying the criteria for the issuance of sales permits, the focus is now on the quality of growth and increased scrutiny on developers’ balance sheets with the “three red lines” policy.

China’s new financing rules require developers’ funding activities to be assessed against three red lines, or thresholds. We believe that these rules will help to moderate the amount of risk taking and reduce overall leverage in the sector, which will be a long-term positive. At the same time, these regulatory metrics provide common measurements across the industry, helping to reduce the ambiguities arising from different reporting criteria across companies.

Active bond managers can add value through credit selection. For example, we are on the lookout for companies that should be able to improve their leverage ratios. We currently favour the larger developers, which have better financial ratios and are likely to enjoy continued access to lending facilities. Meanwhile, the financing guidelines will also restrict new bond issuances, helping to keep net supply manageable which should support bond valuations.

New growth segments; fresh opportunities

COVID-19 does not sound the death knell for Asian real estate. Instead, the evolving sector and new growth segments will create fresh opportunities for investors. We are watching trends in property management, logistics and data centres closely. Meanwhile, changing needs and usage will shape the future of retail and commercial office space, potentially giving them a new lease of life. While oversold sectors present tactical opportunities, we are cognisant that the pandemic will continue to weigh on the hospitality sector if travel restrictions stay in place.

By understanding where the risks and opportunities lie, we believe that a thoughtful curation of Asian real estate equities and bonds can provide investors with a compelling total return which includes a reliable and recurring income stream, in a world where interest rates are expected to remain low.

-- Contact us at [email protected]

-

Equip young people for the future Dr. Winnie Tang

In late February, the inaugural flight of an air taxi from Shenzhen Shekou Cruise Homeport to Zhuhai Jiuzhou Port took only 20 minutes with an estimated one-way ticket price of 200 to 300 yuan per

-

Are we raising a generation of leaders, or of followers? Brian YS Wong

The essence of education is defined not by the facts it imparts, but the potential knowledge it inspires students to individually pursue on their own. Put it this way – the ideal form of education

-

The urgent need for reforms to sex education in Hong Kong Sharon Chau

Nearly one in every four university students (23%) in Hong Kong has been sexually harassed, according to a 2019 report published by the Equal Opportunities Commission (EOC). A 2019 study found that

-

STEAM should be linked to real life Dr. Winnie Tang

In the 2017 Policy Address, STEM (science, technology, engineering and mathematics) education was proposed as one of the eight major directions to promote I&T development. Since then, funding has

-

Let trees speak for themselves Dr. Winnie Tang

I often say that smart cities start with smart planning, but smart planning presupposes adequate, systematic and up-to-date data. This is important not only for city administration, but also for tree