10 things global investors need to know about China equities

Once largely out of reach to foreign investors, China’s equity markets have opened up as the country’s economy transforms. From Shenzhen and Hong Kong listings to the Nasdaq-like STAR board, Chinese companies are attracting significant investor capital. Here’s what you need to know.

1. China’s equity market is large and deep

China’s capital markets have expanded significantly in recent years. The combined market capitalisation of the exchanges in Shanghai, Shenzhen and Hong Kong – plus US-listed American depositary receipts (ADRs) – is USD 18.8 trillion. This is significantly higher than the USD 10 trillion market cap of euroarea equities . Access to such a large market provides attractive opportunities for investors to gain further exposure to China’s growth story.

2. China is investing in innovation – and innovative firms are benefiting

The outlook for China equities is underpinned by government investment in “new infrastructure” – foundational technologies such as artificial intelligence and electric vehicles. These are areas where China wants to reduce its reliance on foreign technologies and become a global leader – and Chinese companies have been benefiting. Case in point: the total number of annual patent filings in China grew more than 450% between 2009 and 2019, dwarfing the filings by the world’s other top economies.

3. China’s equity markets now resemble China’s dynamic economy

China’s state-owned enterprises (SOEs) once held outsized influence over the country’s economy, but significant reforms drove down their share of GDP from 50% to 30% over the last 15 years. In addition, non-strategic SOEs – such as local consumer or technology businesses – are now behaving more like profit-seeking entities. China is also the youngest market regionally, meaning Chinese companies have been part of the region’s major benchmark index for the shortest amount of time. It’s an indication that much of the investment activity that previously took place in private and venture-capital markets is increasingly accessible to investors in listed equity markets. As Chinese equity indices have changed over time, markets have become more dynamic and more reflective of where the economy is headed.

4. Corporate governance in China is improving

Some investors may have previously questioned China’s corporate governance standards, but things are changing. Use of international auditors and accounting standards is growing, with every listed Chinese company required to file quarterly reports and end its fiscal year on 31 December. Moreover, an increasing number of state-owned and privately owned enterprises offer employee stock-ownership programmes. This helps turns employees into shareholders with an active stake in the company’s success.

5. China’s markets can be highly liquid

Domestic retail investors in China dominate the market for A-shares and account for more than 80% of daily turnover . (Markets with high turnover ratios are generally easier to trade because they’re more liquid – meaning more investors are buying and selling.) With the investment culture in China focused more on momentum and short-term trading, the stock turnover ratio of China A-shares is among the highest in the world.

6. China’s equity markets can be volatile, but so can markets in the US

Volatility in China’s equity markets has sometimes been high – but perhaps surprisingly, during the peak of the pandemic crisis in 2020, China was less volatile than the US. There were only three days, for example, when China’s markets moved by more than 5% on a daily basis, compared with 10 days in the US. And while much of the current A-share trading activity is driven by retail investors, China’s equity markets overall are likely to become more influenced by institutional investors over time. This should help push volatility levels closer to those of the so-called more developed markets.

7. China’s equity markets aren’t monolithic

China has many stock exchanges and share classes – reflective of the depth and breadth of its economy – and they all have their own important characteristics. Even within China A-shares, the different listing venues offer varying exposures to sectors, market caps and SOEs. Regional macroeconomic differences can also affect shares: for example, US market performance influences US-listed Chinese ADRs. The net effect of these differences can be seen in the wide dispersion of performance by stock exchange. Investing across China’s exchanges can bring additional diversification benefits, but knowing the nuances of the marketplace is key.

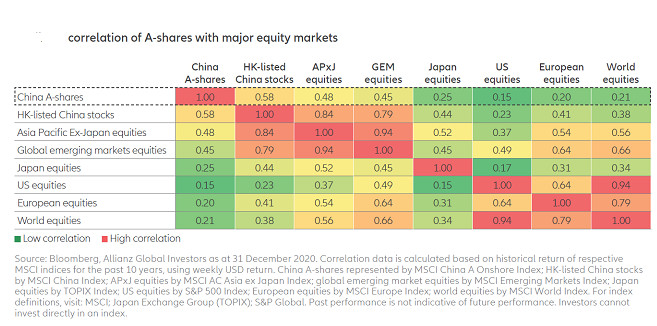

8. Chinese stocks don’t move in lockstep with other equity markets

China A-shares have a correlation of 0.21 with global equities over the last 10 years. That means China A-shares move in the same direction as global equities only

21% of the time. Or looked at another way, almost 80% of the time they move in a different direction. Holding A-shares in a global portfolio may help generate a better risk-return profile. This could be particularly beneficial during steep market drops like those seen during the Covid-19 pandemic, when some highly correlated asset classes fell in tandem.

9. Foreign investors are increasingly attracted to China equities

The Shanghai and Shenzhen Stock Connect schemes that launched a little over five years ago helped integrate Chinese equities into the global financial system by making it easy to invest across borders. For example, investors outside of mainland China can use the Hong Kong exchange to buy A-shares in Shanghai or Shenzhen (known as a “northbound” trade). In “southbound” trades, mainland China residents use the Shanghai or Shenzhen exchanges to buy Hong Kong-listed stocks. Since the Shanghai Stock Connect opened in November 2014, Chinese equities have enjoyed 62 months of “northbound” inflows with only 13 months of outflows. Notably, the ongoing inflows have occurred despite economic and political volatility, implying a fundamental shift towards greater global investment in China.

10. Major global indices are adding large numbers of Chinese stocks

Some of the most prominent global stock indices – the benchmarks against which many investors measure their performance – have been adding Chinese stocks in increasing numbers. This reflects the growing importance of China to the global equity markets. It’s likely also a sign that more foreign investment will be flowing into the region in the future. But compared with China’s economic influence and market scale – it accounts for 16.9% of global economic output, among other factors – the country may still be under-represented on benchmark indices. Investors may want to consider allocating more to China than benchmarks do.

-- Contact us at [email protected]

-

Integration of GIS and BIM can drive development of smart city Dr. Winnie Tang

The China Association for Geospatial Industry and Sciences (“the CAGIS”) released the Top Ten Highlights of China's Geographic Information Industry in 2023, which provides much inspiration. The

-

Equip young people for the future Dr. Winnie Tang

In late February, the inaugural flight of an air taxi from Shenzhen Shekou Cruise Homeport to Zhuhai Jiuzhou Port took only 20 minutes with an estimated one-way ticket price of 200 to 300 yuan per

-

Are we raising a generation of leaders, or of followers? Brian YS Wong

The essence of education is defined not by the facts it imparts, but the potential knowledge it inspires students to individually pursue on their own. Put it this way – the ideal form of education

-

The urgent need for reforms to sex education in Hong Kong Sharon Chau

Nearly one in every four university students (23%) in Hong Kong has been sexually harassed, according to a 2019 report published by the Equal Opportunities Commission (EOC). A 2019 study found that

-

STEAM should be linked to real life Dr. Winnie Tang

In the 2017 Policy Address, STEM (science, technology, engineering and mathematics) education was proposed as one of the eight major directions to promote I&T development. Since then, funding has