Bond strategy: Be patient and accumulate duration on weakness

After a brief period of relative calm in January, volatility of rates in developed markets has again started to pick up. Core inflation numbers have generally disappointed and economic data have held up better than expected, dismissing the notion of a forthcoming recession. The implication is clear: central banks will likely need to raise rates further and keep them there for longer than previously expected. Nevertheless, it is important to realise how far we have already come in this tightening cycle. Developed markets’ central banks have embarked on one of the swiftest and sharpest tightening cycle ever. For example, if the Fed delivers what markets are pricing, the peak policy rate will be the highest since 2000 when the Fed Funds rate topped at 6%. The Fed will have hiked rates by 500bp in a matter of 15 months. At a priced peak rate of 3.7%, the ECB would have also raised policy rates by over 400bp. Additionally, both central banks are reducing their balance sheets, which equates to an additional tightening of financial conditions.

Given the Fed’s own estimate of the neutral rate at 2.5% (at which the economy neither accelerates nor decelerates) and a 2% inflation target, the real neutral rate would equate to 50bp. US 5y5y real rates, a valid estimate for long-term real yields, which currently sit at roughly 150bp, are at a restrictive level. The markets’ clearest signal with regard to the degree of tightness is usually the yield curve. In fact, the Treasury yield curve started to flatten meaningfully once 5y5y real rates crossed above 50bp and has inverted substantially as real rates repriced up further. A similar picture is seen in the euro area, where 5y5y real rates are in positive territory, and with a yield curve that has also inverted meaningfully. Market-implied signals therefore suggest that monetary policy is already tight across the DM rates structure. Looking at inflation dynamics, we note that the market-implied peak Fed Funds rate is now above the 6-month annualised US core CPI rate, indicating that actual real policy rates are positive too. The picture in the euro area is more worrisome with the 6-month annualised core CPI still significantly above market implied peak rates, suggesting the ECB has more work to do.

After a sharp decline in forward-looking indicators last year, flagging a recession in 2023, recent data point to some improvement, albeit from low levels. These indicators seem to be troughing, while services PMIs in Europe and in the US have moved above 50, suggesting expansion. The global manufacturing sector, on the other hand, shows few signs of improvement. Typically, cyclical indicators improve once central banks ease policy and not while monetary policy is still being tightened, [hence the situation now is] casting doubt on the sustainability of this improvement. Historically, it takes 12 months for monetary policy to take full effect. With labour markets tight and fiscal stimuli from the pandemic and cost of living-crises programs still lingering, the lags could be even longer. It would therefore be premature to expect a central-bank-induced slowdown to be visible already in the data.

Central bank policy drives short-term bond yields. Policy rate expectations set the direction also for longer-term yields, and while the bond market can protest by inverting the yield curve, it cannot escape the overall direction of policy rates. Currently, markets are still grappling with pricing the appropriate policy rate trajectory, hence bond yields swing around accordingly. There is not yet enough conclusive evidence that (1) substantial cyclical weakness is forthcoming and that (2) the fight over inflation is won. Hence, probabilities around different peak policy rate scenarios are still a moving target. But one thing is clear: there is not going to be a sustainable bond rally until central banks are close to the end of the hiking cycle. Before then, a reasonable strategy would be to accumulate duration on selloffs (such as the current one) and not to chase the subsequent rallies. The objective is to accumulate duration at reasonable yield levels to prepare for an eventual pivot by central banks.

-- Contact us at [email protected]

-

Integration of GIS and BIM can drive development of smart city Dr. Winnie Tang

The China Association for Geospatial Industry and Sciences (“the CAGIS”) released the Top Ten Highlights of China's Geographic Information Industry in 2023, which provides much inspiration. The

-

Equip young people for the future Dr. Winnie Tang

In late February, the inaugural flight of an air taxi from Shenzhen Shekou Cruise Homeport to Zhuhai Jiuzhou Port took only 20 minutes with an estimated one-way ticket price of 200 to 300 yuan per

-

Are we raising a generation of leaders, or of followers? Brian YS Wong

The essence of education is defined not by the facts it imparts, but the potential knowledge it inspires students to individually pursue on their own. Put it this way – the ideal form of education

-

The urgent need for reforms to sex education in Hong Kong Sharon Chau

Nearly one in every four university students (23%) in Hong Kong has been sexually harassed, according to a 2019 report published by the Equal Opportunities Commission (EOC). A 2019 study found that

-

STEAM should be linked to real life Dr. Winnie Tang

In the 2017 Policy Address, STEM (science, technology, engineering and mathematics) education was proposed as one of the eight major directions to promote I&T development. Since then, funding has

-

Russia’s nightmare – loss of Far East

-

首屆「中華文化節」六月開幕 感受中華傳統文化多元魅力

-

養顏即食花膠靚湯

-

My Brief Remarks – at the HKS China Conference

-

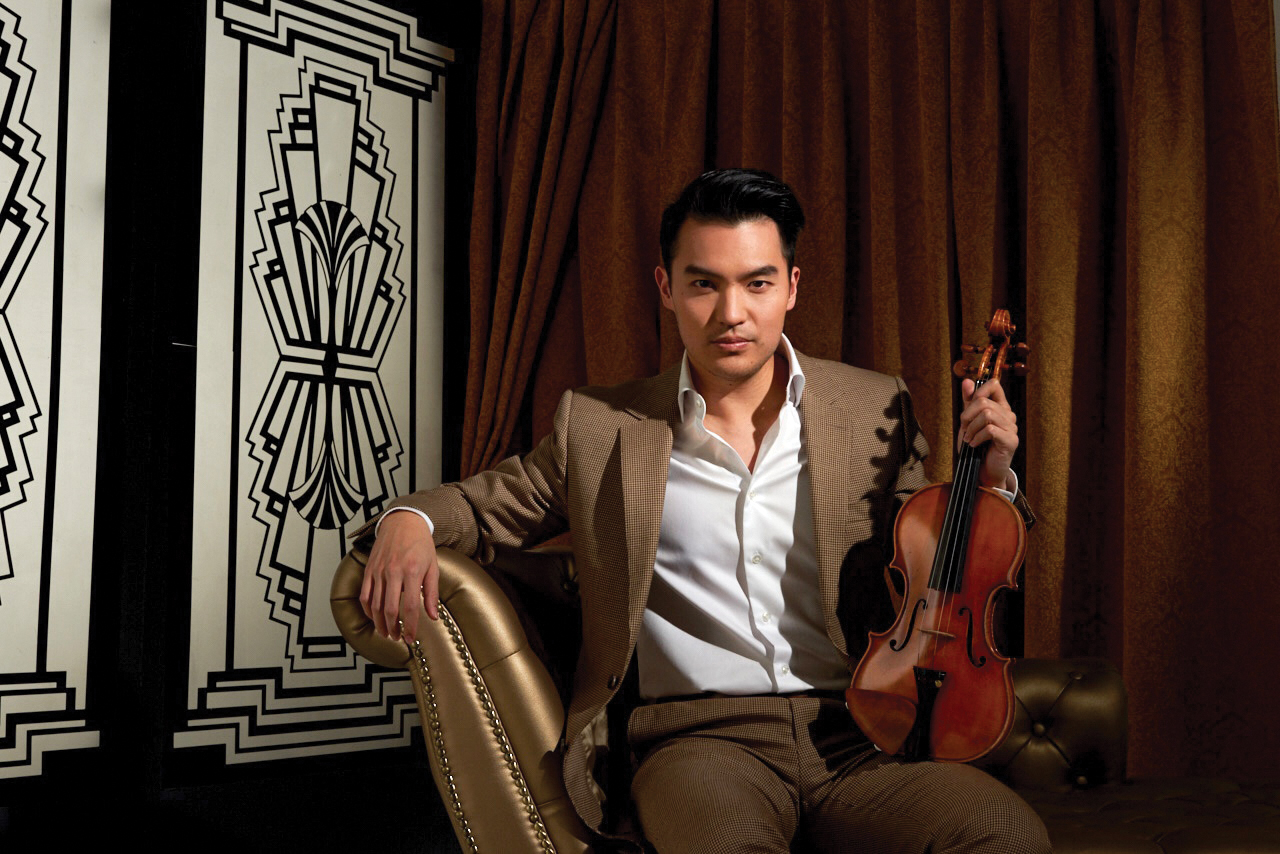

呈獻精彩絕倫的音樂盛會

-

非凡彩寶之旅 Winston Candy & Winston Kaleidoscope系列

-

The perils of self-censorship

-

中華文化節2024系列~八台戲曲亮相中華文化節 新編粤劇《大鼻子情聖》打響頭鑼

-

伊藤詩織:紀錄片是改變的一部分

-

DIOR MEN Fall 2024~Effortless Chic流麗衣櫥