How should Japan respond to inflation?

In the fall of 2021, monetary economists in the United States were sharply divided between those who believed that high inflation would be short-lived (Team Transitory) and those who insisted it was here to stay (Team Persistent). Today, a similar clash can be seen in Japan, though there are very different considerations at play.

America’s Team Transitory based its stance on the benign inflation projections that were being shared among members of the Federal Open Market Committee. As recently as December 2021, projected personal consumption expenditure inflation – the US Federal Reserve’s preferred measure – for 2022 was just 2.6%. Such figures, Team Transitory concluded, called for a slow, gradual increase in the policy rate over 2022.

Team Persistent, however, warned that this would not be enough to curb US inflation, and urged the Fed to undertake sharp increases in the policy rate – starting immediately. The Fed ultimately embraced this recommendation, hiking the policy rate seven times in 2022, for a cumulative increase of 4.25 percentage points. But it did so only after inflation proved to be much higher than Team Transitory’s projections.

Though US inflation now seems to have cooled, the Fed’s slow start likely resulted in larger interest-rate hikes than would otherwise have been needed. The Fed, it seems, was behind the curve. Is the Bank of Japan (BOJ) making the same mistake?

Japan’s headline inflation rate in June – the most recent figure available – was 3.3%, meaning that it has remained above the 2% target for more than a year. The “core-core” inflation rate – which tracks the prices consumers pay for a basket of goods, excluding fresh food and energy – was even higher, at 4.2%. This shows that the main driver of inflation is not energy or fresh food prices, which tend to be volatile, but rather a wide range of other items. For Japan’s Team Persistent, this is enough reason for the BOJ to consider tightening monetary policy.

Japan has maintained ultra-easy monetary policy for years. Since launching its quantitative and qualitative easing (QQE) policy in 2013, the BOJ has purchased more than 50% of outstanding government bonds. This has undermined the bond market’s functioning and encouraged a lack of fiscal discipline.

Moreover, the widening interest-rate gap between the US and Japan has caused the yen’s exchange rate against the US dollar to depreciate sharply, from ¥115 in January 2022 to ¥150 in October 2022. The dollar exchange rate has remained in the ¥135-150 range ever since. One might hope that this would stimulate Japan’s economy by boosting export competitiveness, but no such thing has occurred, at least not to any significant extent.

Japan’s Team Transitory, however, sees no reason to worry about a sharp, let alone persistent, rise in inflation. They might point out, for example, that the BOJ’s board members anticipated in April a core inflation rate (which excludes fresh food but not energy) of 1.8% for fiscal year (FY) 2023, 2% for FY 2024, and 1.6% for FY 2025; and a core-core inflation rate of 2.5% for FY 2023, 1.7% for FY 2024, and 1.8% for FY 2025. The inflation forecasts are still undershooting the target in the medium run. The board’s projections in the July Outlook Report are due to be revised this week.

There is no reason to believe the BOJ’s projections are biased. A recent survey by the Japan Center for Economic Research shows that while private forecasters predict slightly higher price growth (2.6%) for FY 2023, they also expect inflation to fall back below target – to 1.7% – in 2024. The break-even rate of ten-year government bonds – which stood at 1.16% at the end of June – reinforces the view that inflation will decline in the medium to long run.

Team Transitory would also emphasize that this is the first time Japanese inflation has surpassed 2% since soon after the BOJ adopted its inflation-targeting framework in 2013. In fact, whereas inflation expectations are more or less anchored around 2% in the US, Japan has been in a deflation trap for decades; inflation expectations never came close to 2%.

This has had serious consequences for Japan’s economy. With the inflation rate stuck at (or below) zero, firms were unable to raise prices, even when costs rose, which prevented them from raising wages and left consumers extremely sensitive to any price changes. But recent price growth has gone some way toward changing that, spurring wage increases of 3%. For Team Transitory, the conclusion is clear: Japan should view today’s inflation as an opportunity to break its deflationary equilibrium and raise inflation expectations to 2%.

It is worth noting that, far from fearing a wage-price spiral, Japan would have to hope for 2-3% annual wage increases for years to come to reach 2% inflation. Moreover, given that inflation expectations tend to lag behind actual inflation, Japan must be willing to overshoot the target for some time, as former BOJ Governor Haruhiko Kuroda pledged to do back in 2016. By this logic, the last thing Japan needs is inflation-suppressing monetary-policy tightening.

But Team Persistent would warn that another risk is looming. The BOJ will soon release its next Outlook Report, which will include new – upwardly revised – inflation projections. If the BOJ does not raise its yield curve control (YCC) ceiling in line with the new inflation projections, investors could begin short-selling government bonds, just as they did last October and November.

One compromise would be to widen the YCC band from 50 basis points to, say, 75 basis points, but insist that the goal is to maintain the functioning of the Japanese government bond market and not a step toward monetary tightening, just as Kuroda explained in January.

The BOJ undoubtedly faces hard choices. One hopes that the Policy Board’s next meeting, on July 27-28, will produce some clarity on the way forward.

Copyright: Project Syndicate

-- Contact us at [email protected]

-

Integration of GIS and BIM can drive development of smart city Dr. Winnie Tang

The China Association for Geospatial Industry and Sciences (“the CAGIS”) released the Top Ten Highlights of China's Geographic Information Industry in 2023, which provides much inspiration. The

-

Equip young people for the future Dr. Winnie Tang

In late February, the inaugural flight of an air taxi from Shenzhen Shekou Cruise Homeport to Zhuhai Jiuzhou Port took only 20 minutes with an estimated one-way ticket price of 200 to 300 yuan per

-

Are we raising a generation of leaders, or of followers? Brian YS Wong

The essence of education is defined not by the facts it imparts, but the potential knowledge it inspires students to individually pursue on their own. Put it this way – the ideal form of education

-

The urgent need for reforms to sex education in Hong Kong Sharon Chau

Nearly one in every four university students (23%) in Hong Kong has been sexually harassed, according to a 2019 report published by the Equal Opportunities Commission (EOC). A 2019 study found that

-

STEAM should be linked to real life Dr. Winnie Tang

In the 2017 Policy Address, STEM (science, technology, engineering and mathematics) education was proposed as one of the eight major directions to promote I&T development. Since then, funding has

-

首屆「中華文化節」六月開幕 感受中華傳統文化多元魅力

-

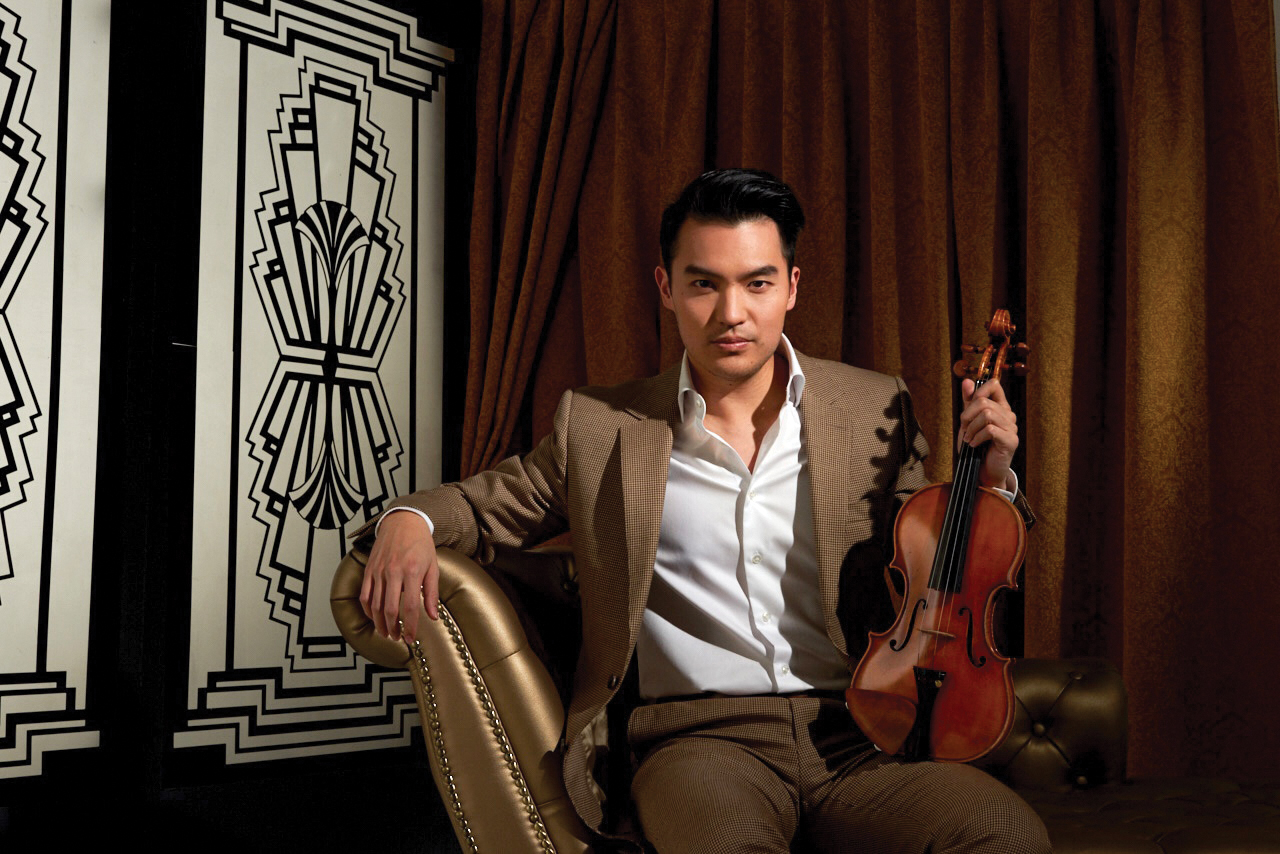

呈獻精彩絕倫的音樂盛會

-

Russia’s nightmare – loss of Far East

-

非凡彩寶之旅 Winston Candy & Winston Kaleidoscope系列

-

My Brief Remarks – at the HKS China Conference

-

中華文化節2024系列~八台戲曲亮相中華文化節 新編粤劇《大鼻子情聖》打響頭鑼

-

The perils of self-censorship

-

DIOR MEN Fall 2024~Effortless Chic流麗衣櫥

-

伊藤詩織:紀錄片是改變的一部分

-

WALTER ALBINI 意大利時裝的無名英雄